13 Ways and Tips for Budgeting to Achieve Your Financial Goals

For some people, budgeting is still something that seems complicated and makes it difficult to enjoy life. However, the purpose of budgeting is actually to manage finances and to achieve financial goals so that you can have fun and enjoy life more calmly, without regrets.

- 1 Here are 13 Budgeting Tips for Beginners

- 1.1 Distinguish Between Needs and Wants

- 1.2 Budget to Zero

- 1.3 Set Your Goals Every Month

- 1.4 Start With the Most Important Things

- 1.5 Make A Schedule

- 1.6 Track and Record Your Budgeting Progress

- 1.7 Pay Off Debt

- 1.8 Cut Off Your Credit Cards

- 1.9 Create Different Bank Account

- 1.10 Create A Buffer

- 1.11 Use Cash For Certain Budget Categories

- 1.12 Find Additional Income

- 1.13 Be Content With Your Budget Plan

Your job is to find out which method that suits your situation. Who says budgeting keeps you from enjoying life? Of course you can! The most important thing is to make a budget from the start.

When you start to see planning a budget as simply spending your money intentionally, you can actually find more freedom to spend.

Once your finance has been budgeted for, you'll be able to spend your money without feeling guilty. Some people even say they find 'extra' money after they create a realistic budget and stick with it.

Here are 13 Budgeting Tips for Beginners

1. Distinguish Between Needs and Wants

One way to manage personal finances is to distinguish between what you need and what you want. Needs are things that are important and you need in everyday life.

When you are going to buy something, don't forget to ask yourself whether the item is the thing you need or just what you want?

If you can distinguish between needs and wants, you will be able to budget better. Avoid buying things that are not necessary if you have not met your needs.

2. Budget to Zero

It means before the month starts, you're making a plan and giving every dollar a name. It's called a zero-based budget.

That doesn't mean you have zero dollars in your bank account. It just means that your income minus all your expenses equals zero.

3. Set Your Goals Every Month

Be sure to adjust your budget goals each month as your needs change. Make a savings fund you can stash cash in throughout the year.

When you don't have a specific plan, you're going to be stressed. And it takes all the fun out of giving and celebrating. Financial goals will make your target and budgeting plan much easier.

When you have financial goals, you will be encouraged to manage your finances as wisely as possible. If you are a little careless, your financial goals will fail to be achieved.

4. Start With the Most Important Things

Once your basic needs and true necessities are taken care of, you can fill in the rest of the categories that you need in your budget.

5. Make A Schedule

You can pick specific dates for other expenses while you're making a budget part of your monthly routine.

You also could set up auto drafts out of your checking account to pay your bills, or you could buy your groceries on a set day every week or twice a month.

When you know what to expect and when to expect it, you take a lot of stress and potential problems out of your life.

6. Track and Record Your Budgeting Progress

Tracking your budgeting will help you move forward. Think about how you can tighten, spend, or maybe even pick up an extra income so you can get to your goals faster.

It's essential to check your progress from time to time. If you're married, get together and discuss your goals with your partner. If not, find someone close to check in with.

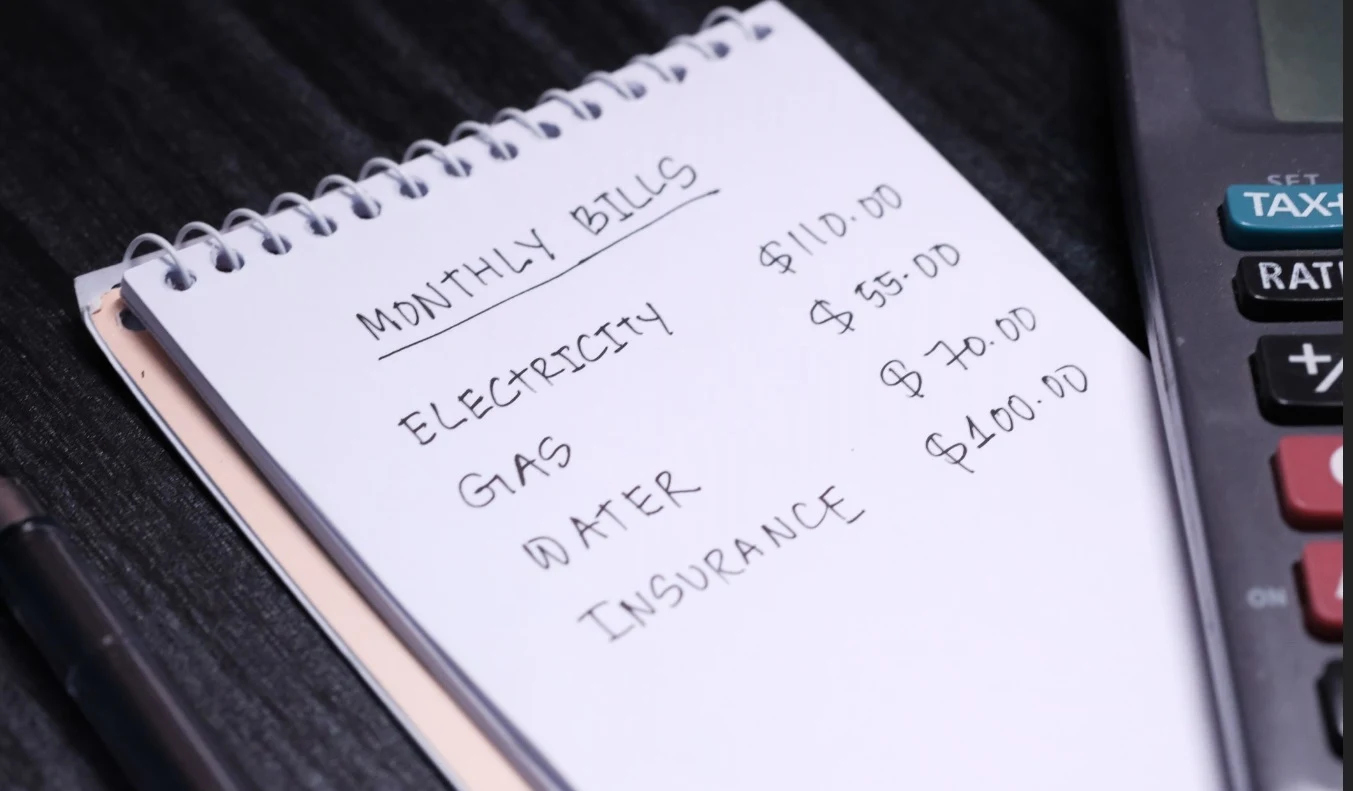

The next step is to record all the income you get every month, including the salary you receive regularly every month as well as your additional income.

Do not forget to also record expenses in detail. This record is very important to know where your money goes each month to achieve your financial goals. This method also can be used by all family members as a way to manage family finances.

7. Pay Off Debt

Stop letting the debt rob you of the very thing that helps you win with your income. If you have debt, paying it off should be a top priority on your budgeting goals.

8. Cut Off Your Credit Cards

If you're really committed to sticking to a budget plan and getting out of debt, you need to ditch your credit cards for good.

Having no credit card debt will mean no more minimum payments to add to the budget, zero scuffle with fees or high interest rates, and less stress and worry. Stick to using your debit card or even cash.

9. Create Different Bank Account

You can divide the monthly salary easily if you have different bank accounts.

This will prevent your money from getting mixed up. So that financial storage becomes more organized. To make it easier, you can first create two bank accounts.

One account to receive salaries from your company, the other for savings. Each month, put a portion of your monthly salary into a savings account. If necessary, enter it as a deposit fund, so that it can last longer in the bank.

10. Create A Buffer

You can put a small amount of money aside for unexpected expenses throughout the month. Label this as your miscellaneous category in your budget plan.

In that way, when something comes up, you can cover it without taking away money you've already put somewhere else.

Keep track of your expenses that frequently end up in this category. Eventually, you might even want to promote them to a permanent spot in your budget plan.

11. Use Cash For Certain Budget Categories

If you're constantly overspending on your grocery budget or fun money, cash out those categories and use the cash system to hold you accountable with the money.

Just go to the bank and pull out the cash amount you've budgeted for those categories. Once the cash runs out, you need to stop spending it.

Do not pull out the cash again until your money in the wallet runs out. This will help you to track your financial goals and control expenses.

With a small amount of money in hand, you will think twice about buying necessities. So only buy what is essential and necessary.

12. Find Additional Income

You can find extra income after work, or "freelance". For people who can make time after working hours, freelance work is a way to arrange an alternative monthly salary when the necessities of life are too big.

In addition, working freelance will also help you secure financially when you suddenly lose your job. Currently there are many business opportunities that can be utilized only from home. You can become a writer, social media influencer, product reseller, and more.

13. Be Content With Your Budget Plan

Don't compare your financial goals and budget plan to anyone else's. Comparison will not only rob you of your joy but also your paycheck.

Keep moving forward and doing what's right. It won't be perfect for the first time but you will get there.